Top 10 Best Private Banks in India List 2024

January 03, 2024

Home Loan Archive | Bank of Baroda Mudra Loan

April 03, 2023

The Indian government established the Pradhan Mantri Mudra Yojana, or PMMY, to offer small and micro non-farm business firms reasonably priced finance. To “finance the underfunded,” this programme was created to include MSMEs in the formal financial system.

Micro and small enterprises can apply for a Bank of Baroda Mudra loan if they make money from manufacturing, trade, or providing services. Under this programme, you are eligible to borrow up to Rs. 10 lakhs without putting up any security. You can apply for this financing option using a fully digital platform provided by the Bank of Baroda.

Table of Contents

ToggleA BOB Mudra loan application is simple to submit online. The application procedure is easy and straightforward. Just adhere to these simple instructions:

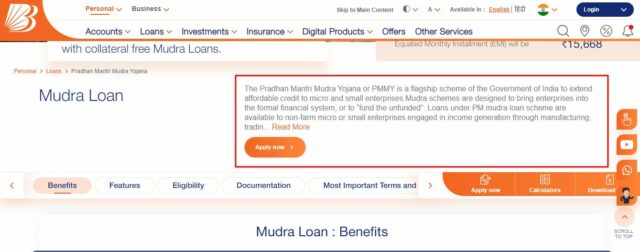

Step 1: Go to the Mudra loan page on the official Bank of Baroda website.

Step 2: Choose “Apply Now” from the menu.

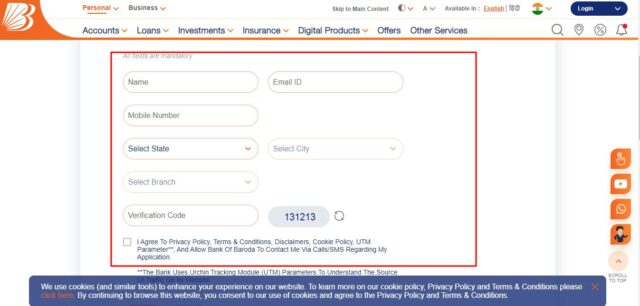

Step 3: Name, contact information, state, and other essential information should be included into the application form.

Step 4: Submit your application after entering the verification code.

A bank representative will contact you once you complete these steps to discuss next steps and document verification.

There are other institutions which offer Mudra Loans, given below is the comparison table:

| Bank/NBFCs | Interest Rate |

| Axis Bank | 14.95% – 19.20% p.a. |

| Bajaj Finserv | 9.75% – 30% p.a. |

| Flexiloans | 1% per month onwards |

| HDB Financial Services Ltd. | Up to 36% p.a. |

| HDFC Bank | 10% – 22.50% p.a. |

| IDFC First Bank | 15% p.a. onwards |

| Indifi | 1.50% per month onwards |

| Kotak Mahindra Bank | 16% – 19.99% p.a. |

| Lendingkart | 1% – 2% per month |

| Mcapital | 2% per month onwards |

Mudra Bank of Baroda According to the stages of a company’s growth, loans are split into three groups. The following loan amounts are available under the schemes:

| Loan Scheme – Mudra | Amount |

| Shishu Mudra Yojna | Upto Rs. 50,000 |

| Kishore Mudra Yojna | Between Rs. 50,000 & Rs. 5 Lakh |

| Tarun Mudra Yojna | Between Rs. 5 Lakhs & Rs. 10 Lakhs |

If your business has not yet been established or is still in the planning stages, you may be eligible for a Mudra loan under this programme. The maximum loan amount under this programme is Rs. 50,000, with a maximum loan term of 5 years. Businesses in the following categories are eligible to apply for the Shishu Mudra Yojana:

Depending on the sort of business you own and your credit history, the interest rate for this loan might increase from 1% to 12%. Furthermore, if you promptly repay the Shishu Mudra Yojana, you can also be eligible for a 2% interest subsidy.

This particular Bank of Baroda Mudra loan programme is provided to aid business owner in maintaining their enterprise. This programme offered loans in amounts between Rs. 50,000 and Rs. 5 lakhs. The interest rate for this plan ranges from 8.60% to 11.15%. If your credit score continues to be low, you might have to pay a higher interest rate.

You can get a Mudra loan of this kind if you want to grow your company. You can get a high-value loan under this programme for a sum between Rs. 5 and Rs. 10 lakhs. Also, the interest rate for this kind of financing is often higher, ranging from 11.15% to 20%. Nonetheless, your loan requirement and credit history will determine the interest rate you must pay.

By examining the features of these programmes, you can use Bajaj Markets to apply for the one that best fits your company’s needs. This diverse industry offers a variety of loans that are issued by top banks and NBFCs. You can review these deals and compare your overall borrowing costs. You can use this to make wise borrowing choices.

Loans under this programme are available to all Micro Small Medium Businesses (MSMEs)—enterprises that generate non-farm revenue. The following extra conditions must be met in order to apply for a Mudra Loan from Bank of Baroda:

The mudra loans provided by the Bank of Baroda hold some amazing features and benefits. Some of the major features are as follows:

While applying for a Bank of Baroda Mudra Loan, the following documentation must be submitted:

Voter ID card, driver’s licence, Aadhar card, PAN card, and passport self-certified copies.

Current utility bills, property tax receipts (not older than two months), Aadhar cards, voter identification cards, and the passport of the proprietor, partners, or directors.

Copies of pertinent licences, registration certificates, and other papers pertaining to the ownership, identity, and address of the business unit

Call 18002584455 or 18002584455 if you have any questions about the Bank of Baroda Mudra loan.

Depending on eligibility, Bank of Baroda offers payback terms of up to 7 years with moratoria. Borrowers of working capital loans are eligible for a 1-year repayment period.

No, a Mudra Loan cannot be used to finance a home loan from Bank of Baroda.

There are three types of Mudra Loan available from Bankd of Baroda like Shishu Mudra Yojna, Kishore Mudra Yojna and Tarun Mudra Yojna.

The interest rate charged on Bank of Baroda’s Mudra Loan starts from 0.050% and ranges to 1.25%. What is the repayment period for Mudra Loan from Bank of Baroda?

Can a Mudra Loan be used to finance a home loan from Bank of Baroda?

What are the types of Mudra Loan available from Bank of Baroda?

What is the interest rate charged on Bank of Baroda Mudra Loan?

© 2024 www.urbanmoney.com. All rights reserved.

Need Loan Assistance?

Thank you for showing your interest. Our agent will get in touch with you soon.