Top 10 Best Private Banks in India List 2024

January 03, 2024

CIBIL Score Archive | What Is a CVV Number and How Do I Find It?

April 11, 2023

Modern life would not be the same without credit or debit cards, and for good reason. They not only make it simple and easy for you to spend money but also have a number of advantages like security and fraud prevention. Knowing your credit card’s CVV number is crucial if you want to maximize its use and capitalize on its benefits.

When you use your credit or debit card to make an online transaction, more details than just the card number and expiration date are required. Your CVV number is also necessary for the vendor to complete your purchase. Read on to learn more about CVV, including what it is, where to locate it, why it’s so crucial, and more.

Table of Contents

ToggleThe term “CVV number” actually stands for Card Verification Value. It is necessary to finish card transactions, but it also adds another layer of protection against fraud. The CVV number is generally used to confirm that you are in possession of the card when you make an online or phone transaction. Only the owner of the physical credit card is aware of the number because it is not written on any invoices or statements.

American Express employs four digits instead of the usual three that Visa and MasterCard use. It is located near to the signature area on the card’s backside.

The cardholder’s card number, PIN, or card expiry date are not used to determine the CVV number, which is unique. The transaction must be good for the CVV to be entered correctly. The process requires two layers of authentication, including the correct card number and CVV number, which is why.

This makes sense because it assumes that the Card’s user truly has the card in their possession and is thus the rightful owner.

The terms “Card Security Code” (CSC) and “CVV2 numbers” are also used to refer to CVV numbers, which are identical to CVV numbers but were created using a second generation technique that makes them more challenging to figure out.

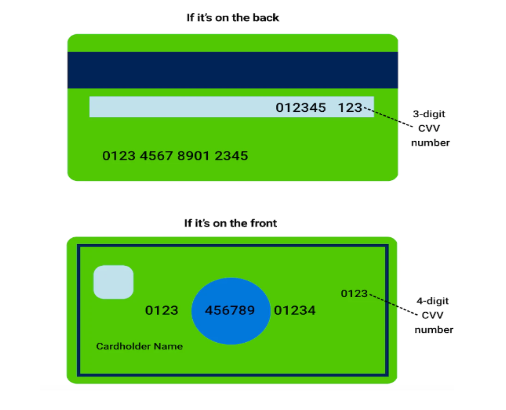

The CVV number is a three-digit identifier on the back of Mastercard, Visa, and Discover credit cards. It is typically to the right of the signature area.

The cards issued by American Express vary slightly. These cards have a four-digit code that is typically printed on the front, on the far-right side, and immediately above the card number.

Some of the CVV components of debit or a credit cards are as follows:

Every financial organization that issues credit or debit cards has put in place a system where each card gets a unique CVV code. The cardholder must use this code to finish all financial transactions. The PIN number is different from the CVV number because it serves as a kind of password to finish card transactions. This number is located on the magnetic strip on the rear of your card. When the card is used for the purchase, it verifies that it is in fact there.

The security code “CVV,” which means “Card Verification Value,” is printed on the card’s backside of a credit or debit card. It usually has three or four numbers, but because there is a magnetic chip, only the 3-4 digits are visible. Many online purchases require this code, which should be always kept private to prevent fraud or unauthorized use of the card.

The term “CVV” may also be referred to as “CSC” (Card Security Code),”CIN” (Card Identification Number), “CVC” (Card Verification Code), or “CVV2.” If you need to input any of the alternate names while initiating an online transaction, do not be confused.

The three or four digits that make up a CVV or CVC are printed on your credit card or debit card. When you make a remote purchase, such as when you order something over the phone or online, it is used as a security function because neither you nor your card need to be physically present.=

The code serves as both a scam deterrent and proof that you actually own the card. If your credit card or debit card information is stolen but not the actual card, it may help prevent fraud.

The CVV number is extremely crucial for any kind of online transactions

If your credit card is stolen, there is a danger because the thief will have access to your CVV and credit card number, which they can use to make fraudulent transactions. Because of this, credit card firms developed the concept of a PIN number. Every time you make a purchase at a merchant site, a 4-digit PIN must be entered. The second line of defense for merchant operations was provided by this.

A second layer of security for internet transactions is provided by the CVV number. Without the CVV number, thieves cannot use your credit card even if they have the card’s name and expiration date. In essence, the CVV number guards your credit card against internet fraud.

The other security measure besides CVV is the OTP that one receives on the registered contact number. A One-Time Password is referred to as OTP. Every time you attempt to conduct a deal online, an authentication code—usually 6 or 4 digits long—is generated. You must enter it in the OTP field after receiving it as a text message on your mobile device in order to finish the transaction.

It only has a single use and is only good for a short duration. Thus, it expires after a certain period of time and cannot be used improperly. Additionally, the OTP is only sent to the credit card holder’s registered cell number, so there is very little chance that it will be misused unless your phone is lost or stolen.

Even though the CVV adds an extra layer of protection, it is not error-proof. Scammers found it very simple to defeat this authentication technique. Scammers can easily obtain CVV numbers by stealing confidential information or by coercing victims into disclosing their code. OTP provides greater security because it can’t be easily stolen and is only sent to the registered mobile number of the credit card holder.

Yes, CVV and a PIN are two different security measures, PIN is required when one uses the card at ATMs or for in-person purchases, while the CVV is utilized when making payments over the phone or internet.

No, it is neither safe nor advisable to share your CVV number with anyone either online or offline.

A CVV number is 3 digits.

No, one can not change the CVV number. Is there a difference between a CVV and a PIN?

Is it safe to share my CVV number online?

How many digits does a CVV number typically have?

Can I change my CVV number?

© 2024 www.urbanmoney.com. All rights reserved.

Need Loan Assistance?

Thank you for showing your interest. Our agent will get in touch with you soon.